How? By elevating your customers’ shopping experience and making Voog subscription plans more accessible to organizations big and small.

Voog Pay will be publicly available beginning with April 8, 2024. The changes to our transaction fee policy will come into effect at the same time.

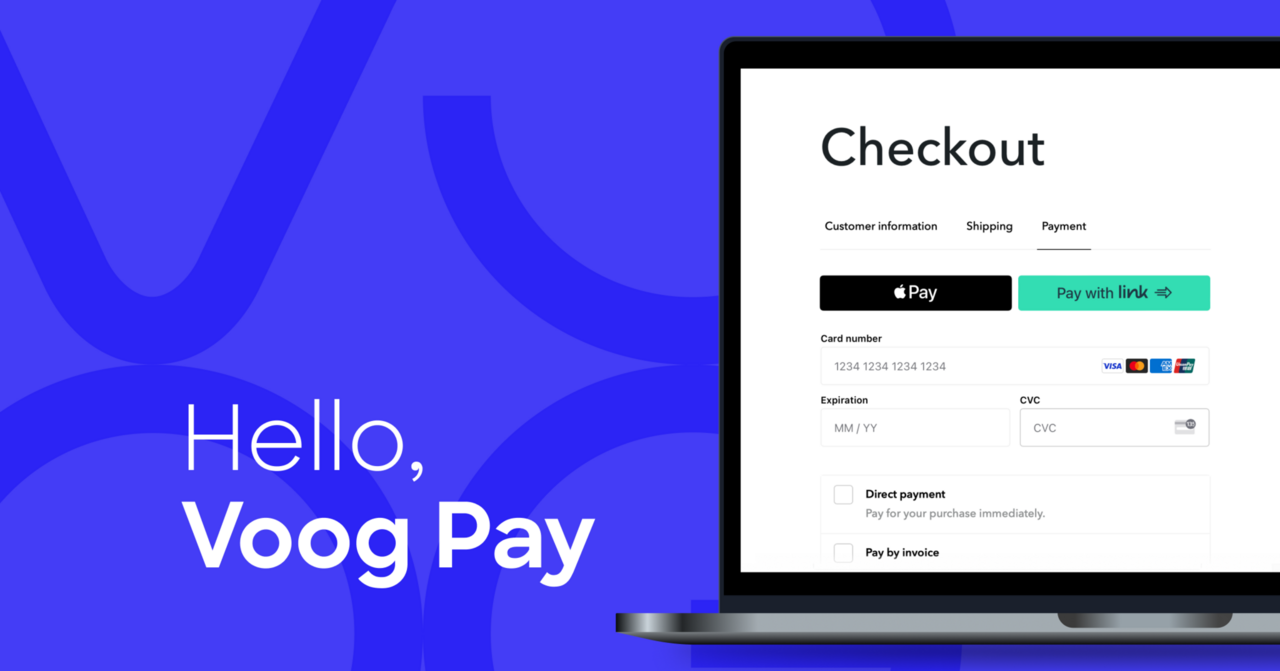

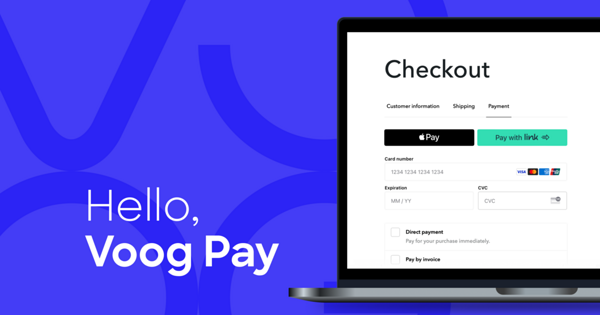

Introducing Voog Pay

First on our list of updates is Voog Pay, a seamless, in-store one click payment solution for all online stores built on Voog. This solution will make your customers' shopping experience easier and better. With Voog Pay, global payment services like Apple Pay, Google Pay, card payment forms, and one click checkout will all be integrated within your store's checkout view. And that’s not all.

No more redirects

We all know payment page redirects are a significant turnoff for online shoppers. On the flip side, in-store one click check-outs have been shown to encourage customer loyalty and swift purchases. With Voog Pay, clients checking out of your online store will complete payments on the same page as their shopping cart with just one click — so no more redirects!

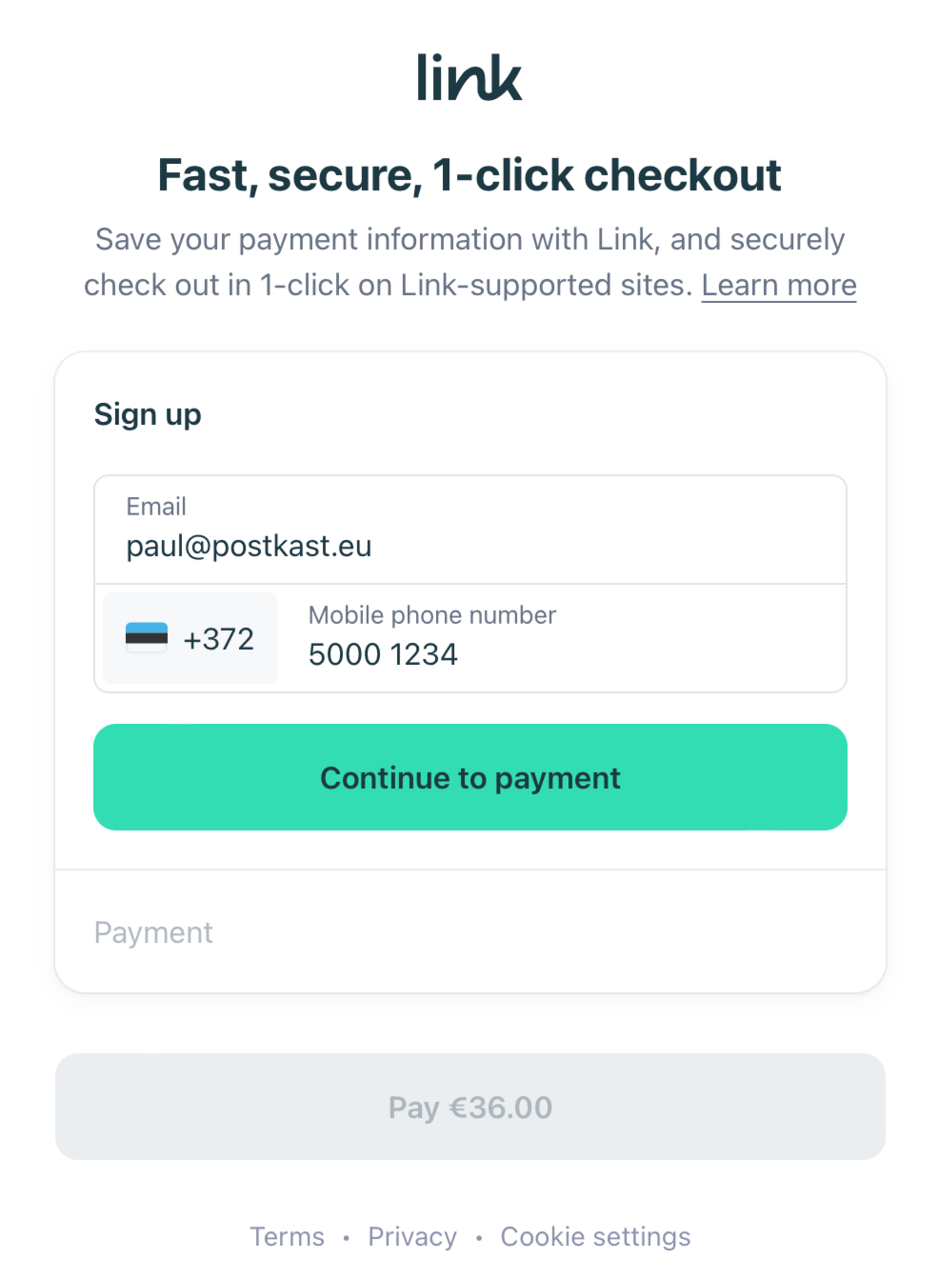

Easy repeat buys

Voog Pay also simplifies repeat purchases for your customers through Link. Adding Link to your online store enables autofill for payment details at checkout, which is said to boost checkout conversion rates by 7% by eliminating the manual work of entering card details every time.

Link is ideal for shoppers who prefer credit or debit cards to digital wallets. Paying via Link means customers will add their card details just once. For repeat purchases, they receive a quick code on their phone or email.

Other Voog Pay features

Voog Pay streamlines your online sales with other features like:

- Easy setup. Forget the hassle of negotiating contracts or fees. Simply provide your company and bank account details to get started quickly and easily.

- One dashboard. Handle all your payment methods, payouts, and chargebacks in one place. Spend less time on financial admin and more on growing your store.

- Simple payouts. Receive daily payouts to your connected bank account.

Changes in our transaction fee policy

The Spring updates also include a change in our transaction fee policy, meant to encourage businesses to grow at their own pace. Long story short, we’re dropping our 3% transaction fee for all sales processed via Voog Pay across ALL Voog subscription plans. No need to upgrade to the Premium plan when your sales go up just to dodge this fee anymore.

Available payment methods for online stores

Voog Pay features a wide range of payment methods that vary slightly from country to country, but here are some of the most relevant ones:

- Credit and debit cards (Visa, Mastercard, American Express, Cartes Bancaires, Interac, and others) account for 41% of online payments globally. You want to have this payment method activated.

- Digital wallets like Apple Pay and Google Pay offer extremely convenient ways to pay. Their two-factor authentication, such as Face ID, not only tightens security but also tends to lower dispute rates.

- Buy now, pay later methods like Klarna allow customers to spread the cost over time, making it easier to purchase high-value items. You get paid upfront, while customers enjoy the flexibility of installments.

Overall, you can access and add more than 100 payment methods via Voog Pay. Select and switch on the most relevant ones for your target market.

World-class security and dispute handling

Voog Pay, powered by Stripe, means not just convenience but world-class fraud prevention, disputes, and chargeback handling. The fraud prevention system leverages machine learning and is trained on data from millions of global companies. The system dynamically adapts to new fraud patterns.

How much does using Voog Pay cost?

Fees start at just 2% + €0.30 per transaction. Each transaction incurs a fee of 0.5% + €0.05 from Voog, plus applicable Stripe processing fees. For example, in the case of European credit cards, the total fee per transaction is 2% + €0.30, out of which 0,5% + €0.05 is Voog's fee and 1.5% + €0.25 is Stripe's.

No additional 3% Voog transaction fee will be applied to payments via Voog Pay in any subscription plan.

Combining Voog Pay with other payment services

In addition to Voog Pay, it's worth having other payment gateways switched on. Up to 9% of shoppers abandon their carts if they don't find their preferred payment option.

Recognizing the popularity of local bank payment initiation services, we encourage the use of our partner payment gateways such as MakeCommerce, Montonio and others for those who prefer traditional methods like Swedbank, SEB, and LHV payment initiation services.

Voog's flexible approach ensures that your store can cater to all customer preferences without compromising on the overall user experience.

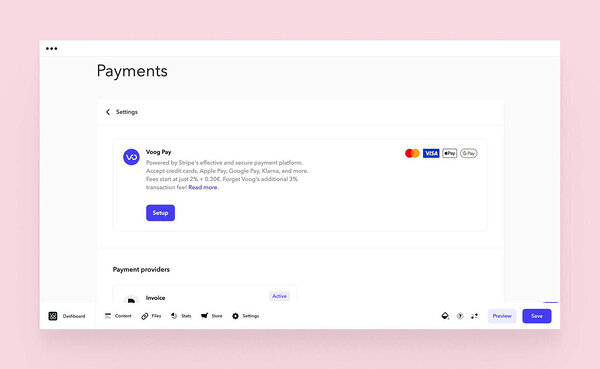

Setting up Voog Pay

Setting up Voog Pay is very simple. Dive into your store’s payment settings, connect with Stripe, and just fill in a few details about your business and connect your company's bank account. Voog and Stripe guide you through selecting your payment methods. A swift toggle later, and Voog Pay springs to life in your shopping cart.

This is the smoothest payment gateway setup journey we've ever offered.

We can help

Do you need help setting things up? Our friendly support team is here to make your switch to Voog Pay even smoother. Write to us at support@voog.com.